Introduction

Rob Emmett, CEO of Collins Home Loans, recently gave a presentation to a group of financial planners, solicitors and accountants about commercial lending practices. Here is a summary of his presentation.

With the majority of media and public attention on residential lending, commercial lending has often been overlooked as a viable `solution for many small to medium business owners.

The Australian economy is built on small business, with more than 2.1 million small to medium businesses operating Australia-wide. History tells us that our nation benefits from a flourishing small business sector. But access to a range of finance options has traditionally been an impediment to growth for many small businesses, primarily due to the restrictive commercial lending practices that have been in place in Australia.

The Reserve Bank’s (RBA) May 2016 financial data, noted that loan volumes from bank and non-bank lenders, for commercial/business lending has grown by 7.1 percent for the 12 months to May this year, while home lending grew by 6.9 percent.

The RBA also noted that similar to residential lending, commercial lenders now see mortgage brokers as a viable distribution channel for business/commercial credit. At the same time, there has been active measures by the Australian Prudential Regulation Authority’s (APRA) to curb the growth of investor lending, especially in Sydney and Melbourne. As well as this, increased interest from the big four banks in commercial lending for small to medium business customers.

How do commercial loans work?

Commercial loans are designed for business purposes. This can be to fund business operations and purchase commercial property, broadly divided into three categories - retail, industrial and office property. Commercial loans can be taken out by individuals or corporate entities and often require detailed business and personal information in order to secure the loan.

There are various benefits to commercial loans, as they are tailored for use by businesses. They offer flexible repayment options to support fluctuations in cash flow, there are products specifically designed for commercial purposes, such as leasing finance, and the loan amounts on offer are usually much higher than with other loans.

The role mortgage brokers play in commercial lending

So could it be that the improved access to commercial lending by Mortgage Brokers is opening up the sector and making commercial lending more available and accessible?

“Just as mortgage brokers have driven change in the home loan sector by driving banks to provide more product diversity and more competitive rates, so to will they do the same for commercial lending.” Rob Emmett said.

This observation is based on several key principles as to why mortgage brokers have been so successful in the residential home loan market. “In short, mortgage brokers bring a client-centric approach to commercial lending in the same way they did in the residential mortgage space”. he said.

So why consider a mortgage broker for your next commercial lending venture?

Standard residential lending products are not generally available to consumers when commercial property or commercial ventures are involved. There are a number of key reasons to consider a mortgage broker for your next commercial lending venture:

- Brokers act on behalf of their clients - no lender bias. They negotiate with lenders on your behalf.

- Pinpoint finance that best suits their client’s individual circumstances - rates, products and features.

- Our brokers are accredited under ASIC licence, members of the industry association MFAA and hold a Diploma of Finance, as a minimum.

- Constant research and market knowledge.

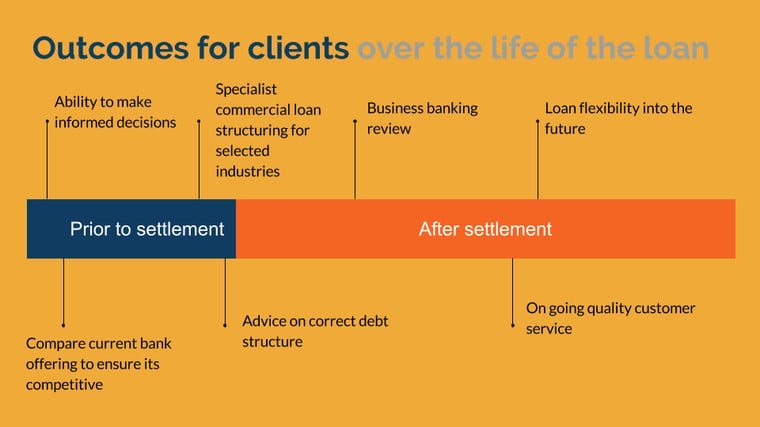

- Long-term assistance as circumstances change.

Summary

Unlike residential loans, commercial lending requries a more tailored response with pricing rarely set in stone. Finding the right lender for your commercial purchase requires a great deal of knowledge and understanding of the commercial lending.

Collins Home Loans offers a suite of commercial lending products with a range of features and options tailored specifically for customers looking to borrow funds for a commercial ventures. Contact Collins Home Loans to discuss your next (or first) commercial venture. Talk to a Commercial Mortgage Broker at Collins Home Loans today.